Refinitiv: May 2022 was another positive month for the European ETF industry since promoters enjoyed inflows.

Inscrivez-vous pour recevoir les Newsletters gratuites de ETFWorld.fr

By Detlef Glow, Lipper’s head of EMEA research at Refinitiv

These inflows occurred in a negative and volatile market environment in which investor sentiment was impacted by high inflation rates, increasing interest rates, geopolitical tensions, and disrupted delivery chains caused by the still ongoing COVID-19 pandemic in Europe and other parts of the world. The performance of the underlying markets led to decreasing assets under management (from €1,322.1 bn as of April 30, 2022 to €1,308.9 bn at the end of May), since the estimated net inflows could not offset the impact from the declining markets. In more detail, the decrease of €13.2 bn for May was driven by the performance of the underlying markets (-€15.7 bn), while estimated net sales contributed €2.5 bn to the assets under management.

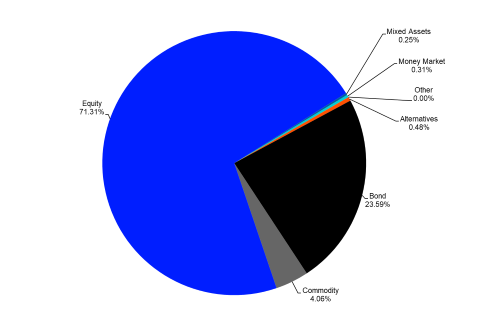

With regard to the overall structure of the European ETF industry, it was not surprising equity funds (€933.4 bn) held the majority of assets, followed by bond funds (€308.8 bn), commodities products (€53.2 bn), alternative UCITS products (€6.3 bn), money market funds (€4.0 bn), mixed-assets funds (€3.2 bn), and “other” funds (€0.1 bn).

Graph 1: Market Share, Assets Under Management in the European ETF Segment by Asset Type, May 31, 2022

Source: Refinitiv Lipper

Fund Flows by Asset Type

The European ETF industry enjoyed healthy estimated net inflows for May (+€2.5 bn) which were far below the rolling 12-month average (€11.5 bn).

The inflows in the European ETF industry for May were driven by equity ETFs (+€1.3bn), followed by money market ETFs (+€0.6 bn), bond ETFs (+€0.5 bn), and mixed-assets ETFs (+€0.04 bn). On the other side of the table, alternative UCITS ETFs (-€0.00002 bn), “other” ETFs (+€0.001 bn), and commodities ETFs (+€0.03 bn) were facing outflows.

This flow pattern drove the estimated overall net inflows to €2.5 bn for the month. Given the general negative market environment, it was surprising that bond and equity ETFs enjoyed inflows for the month.

Source: ETFWorld

Newsletter